My C Thomas Thames Review > Actual irrefutable documentation proof of all SIX surrender charges

TOM THAMES' CONSTANT & REPEATED ANNUITY FLIPPING ADVICE

A common truth suppression technique is to try to create a bubble of unknown in order to confuse people. One of Tom’s clever little tactics of deception has been to suggest to know-nothing readers that there might be some mysterious piece of insurance company documentation that (as he says) will demonstrate that his client “knew what he was doing” and that this will effectively “vindicate” Tom. This is just more of Tom’s flailing Baghdad Bob nonsense. Whether the client “knew what he was doing” is irrelevant and has NO BEARING on the fact that Tom processed all of these costly transactions. An annuity is a contract. NOBODY can enter into a contract without signing it. We already know that!!! So it's a straw man argument to begin with. But maybe Tom hopes to distract attention away from HIMSELF and what HE did by blaming the client for following his advice. I don’t think any reader would be dumb enough to fall for this distraction. It’s actually an indictment on his character that he would blame the client for his annuity flipping "recommendations"!

Don’t expect Tom to talk about the fact that advisers have a DUTY to make sure that their clients NOT absorb excessive transaction costs (in this case over $59,000). That’s what this review is all about, yet Tom has written enough flailing nonsense to fill a book about everything BUT his duties as an adviser.

Tom has also used misleading language like "false claims", "unsubstantiated claims" and at one point claimed that his client hasn't posted one "scrap of evidence". This is complete nonsense because anyone who has ever visited this site in the last 3 1/2 years quickly realizes that in reality a mountain of documentation has always been posted!Variable annuities with massive surrender penalties are not "trading vehicles" (like stocks) and advisers should never ever constantly and repeatedly "trade" them like stocks, but this is what Tom did. Annuities with long surrender periods are intended to be held for many years -- not months! This is a fact. There is no "other side of the story". Unlike Tom, I am asking any reader who has any questions to just ask any independent investment professional or securities attorney. In fact you could ask any product pushing insurance agent who earns their living by pushing annuities on people. They too will tell you the exact same thing! Annuities with massive surrender penalties are NOT trading vehicles and advisers are not supposed to treat them as such! That is why these transactions speak for themselves by themselves...

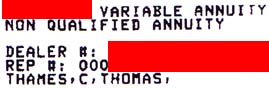

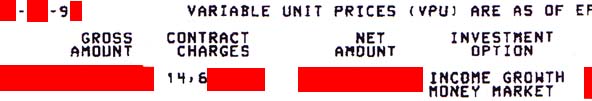

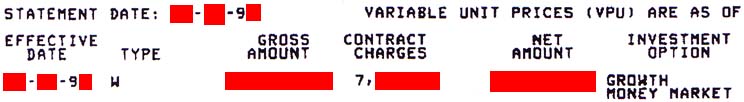

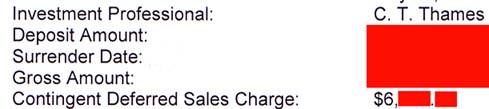

Above: Actual irrefutable documentation provided to me from "Company B" that shows a "contract charge" of over $14,600 because, as per Tom's recommendation, it was surrendered after less than 7 1/2 months. A representative with Company B has confirmed for me that "contract charge" is their terminology for (early) "surrender charge". The same document lists the dealer / rep at the time of surrender as none other than C Thomas Thames. As a percentage of the contract value the surrender penalty was over 7%!!!

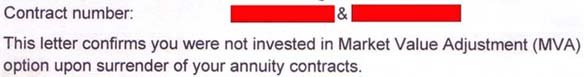

BELOW: Tom's last act of distraction is to claim that there might have been a positive "market value adjustment" (MVA) and that he conveniently doesn't remember. There was no MVA. MVA applies to fixed accounts. I was not invested in fixed accounts! The documents confirms this and for good measure the insurance company also confirmed this for me in writing in an email (below). But leave it to Tom to attempt suggest otherwise to know-nothing readers. To suggest that MVA might have offset a massive surrender penalty is a laughable assertion for someone who has been doing this since 1975 to make because 1) the $14,600+ surrender penalty was too massive to be offset by any MVA, and/or 2) even if the insurance company did allow for MVA, this annuity was allocated into "income growth" and "money market" sub-accounts (this is clearly indicated in the image above). Inherently there could not have been any MVA because these are not fixed accounts. Don't expect Thomas to mention this in his ramblings. It wouldn't surprise me if at some point, in an act of pure desperation Tom just starts calling all of the insurance companies "liars".

Above: More actual irrefutable documentation provided to me from Company "B" that shows a contract charge (early surrender charge) of over $7,000 because it was surrendered after less than 8 months as per Tom's recommendation. As a percentage of the contract value the surrender penalty was over 7%!!! The same document lists C Thomas Thames as the dealer / rep at the time of surrender. Again, as previously described in the above email, there was no MVA regarding this "Company B" annuity. "Growth" and "money market" could not be affected by MVA anyway because they are not fixed accounts. Don't expect Tom Thames to mention this reality.

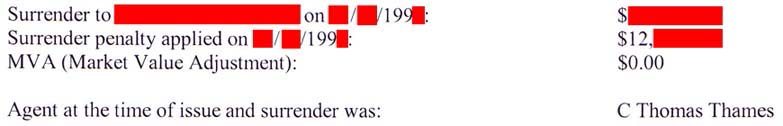

Above: Relevant part of a letter sent to me from "Company D" confirming another variable annuity surrender that was recommended and processed by Tom Thames at a cost of over $12,000 to his client. Tom called for this annuity switch after just getting in only about 4 1/2 months and 8 months earlier. As a percentage of the contract value the surrender penalty was over 4.5%!!! I also asked for this insurance company to indicate whether or not there was MVA. There was none. I think it's clear as day that the primary reason Tom recommended this transaction had to be for his own monetary benefit because no other reason could even begin to justify a client paying all of these surrender penalties. Again, this was the whopping 5th time Tom changed his mind after mere months, and he would later change his mind about the next annuity he recommended after only 8 months and 2 days!

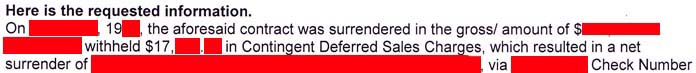

Above: Letter from company "A" confirming surrender charges (over $17,000.00) that I paid due to C Thomas Thames once again "changing his mind" even though annuities are not trading vehicles. Tom sold me this variable annuity contract then recommended that I surrender it, actually beginning the surrender process only about 8 months and 2 days later. As a percentage of the contract value the surrender penalty was over 7%!!!

Tom's "last act" of distraction was to claim that there might have been a market value adjustment that may have offset this huge penalty. This is of course absurd. The insurance company has confirmed for me in writing that there was no MVA regarding either of these two annuities (above and below).

Above: Letter from Company "A" confirming surrender charges (over $6,000.00). Annuities are not trading vehicles but Tom "changed his mind" about this annuity that he sold me too. Tom's initial call to proceed with the surrender actually came after only about 2 months and 10 days! And again, the insurance company has explicitly stated that there was no MVA regarding either of these 2 annuities issued by "Company A". As a percentage of the contract value the surrender penalty was over 7%!!!

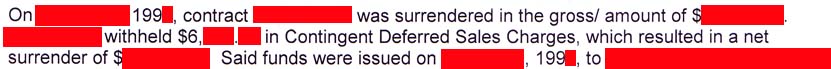

Above: Company "C" surrender charge of over $1,100.00. This annuity contract was surrendered after less than 17 months. As a percentage of the contract value the surrender penalty was over 3.5%!!!

NOTE: No MVA was indicated anywhere throughout the rest of this statement. The insurance company has informed me that with this annuity I was invested with variable sub-accounts -- Not any fixed account. It is only with “fixed accounts" that there even could have been an MVA adjustment. For any casual reader who is still confused by MVA or anything else, simply ask any financial professional or securities attorney to review this page, not to mention the fact that Tom was paid.

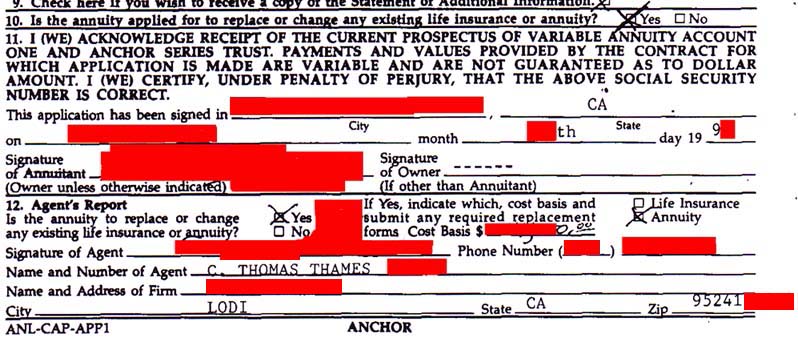

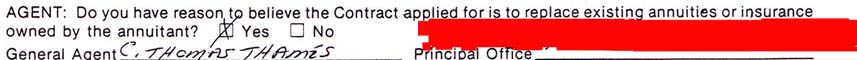

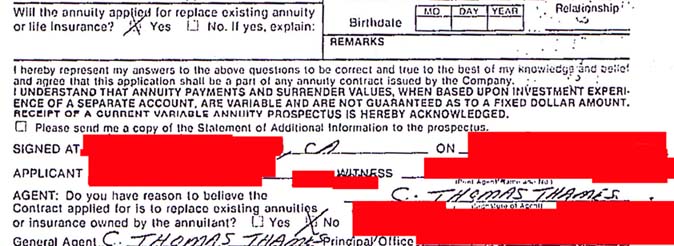

ABOVE: Identifies Tom as the agent who processed this annuity surrender. This form was filled out by Tom himself.

ABOVE: Identifies Tom as the agent who processed this annuity surrender. This form was filled out by Tom himself.

ABOVE: Identifies Tom as the agent who processed this annuity surrender. This form was filled out by Tom himself.

It's a good thing that I saved all of the relevant documentation! Otherwise a very discriminating reader might look at this as a case of my word against his and be tricked into thinking that Tom was the victim of some sort of false review, as he likes to continually portray himself. But for anyone who has at least read this far, they are no longer being fooled by Tom Thames.